capital gains tax philippines

Capital Duty Non-Tax Planning. The property is directly and jointly owned by husband and wife.

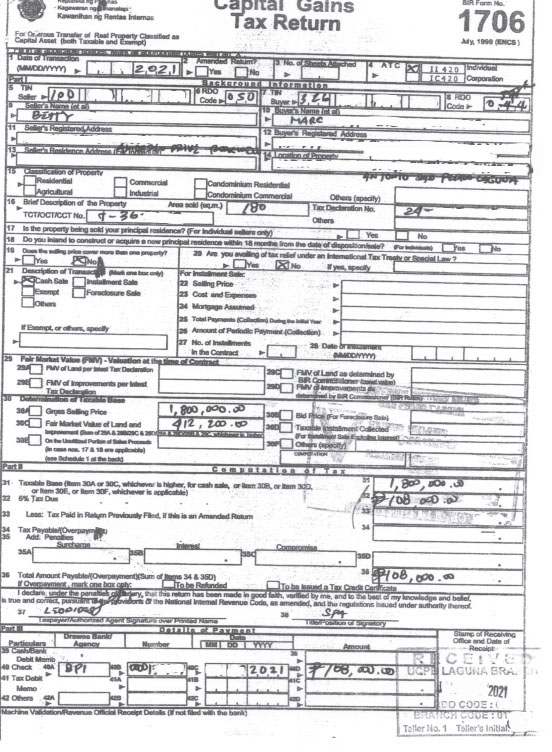

Bir Form 1706 Fill Online Printable Fillable Blank Pdffiller

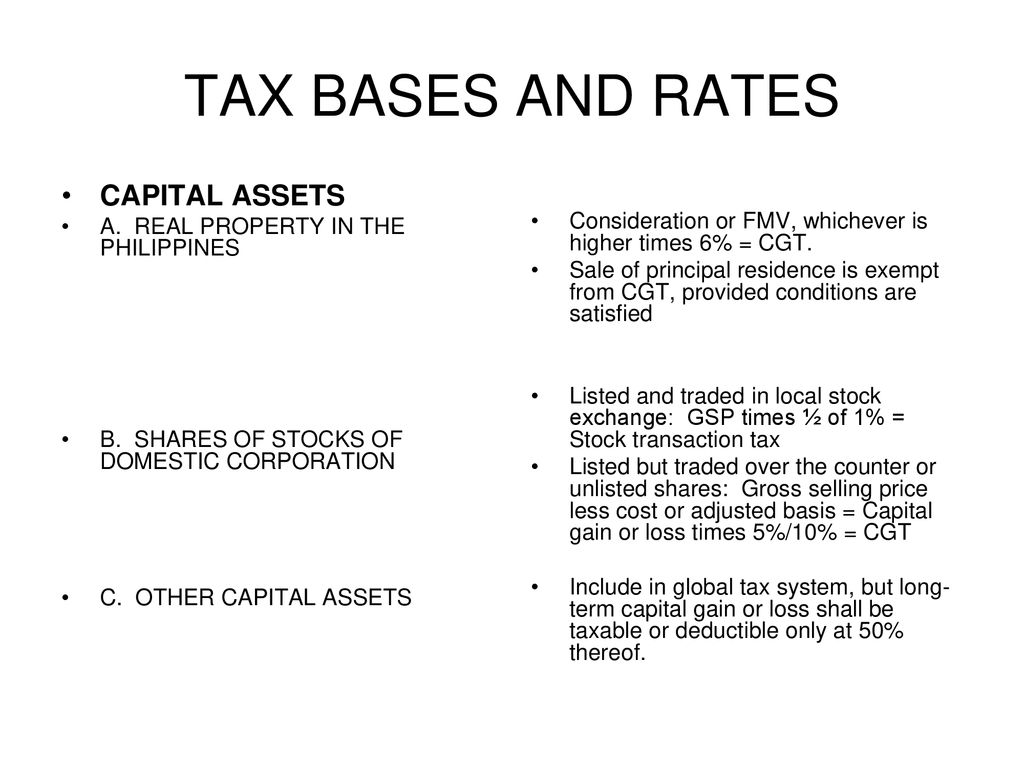

Capital gains tax on sale of real character located in the Philippines and held as capital asses is based on the presumed gains.

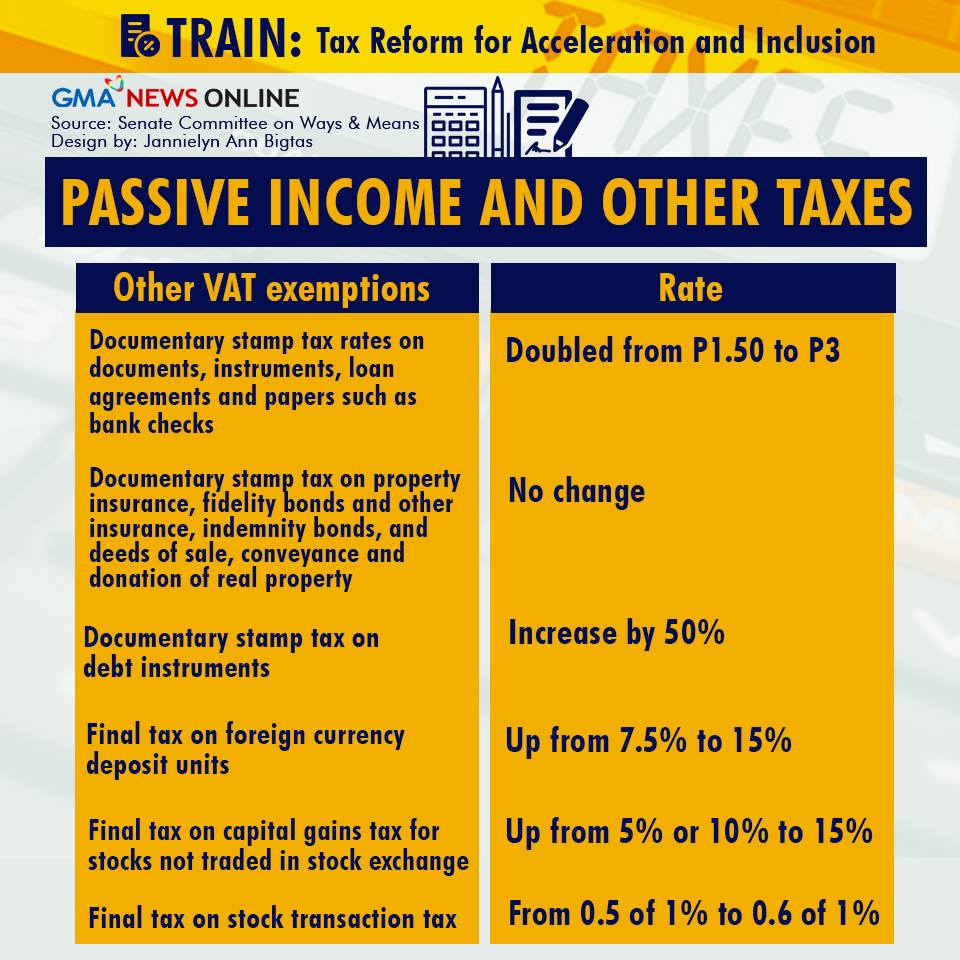

. However gains realized by a domestic corporation or a resident foreign corporation on the sale of shares in a domestic corporation that is not traded on the stock exchange are subject to a 15 capital gains tax. - The provisions of Section 39 B notwithstanding a final tax of six percent 6 based on the gross selling price or current fair market value as determined in 24 accordance with Section 6 E of this Code whichever is higher is hereby imposed upon capital gains presumed to have been realized. The payment of the capital gains tax is dependent and is a direct consequence of the sale transfer or exchange.

According to the Philippine Tax Code Capital Gains Tax is a tax that is imposed on earnings that the seller has gained from the sale of capital assets. Capital Gains Tax is a tax imposed on the gains presumed to have been realized by the seller from the sale exchange or other disposition of capital assets located in the Philippines including pacto de retro sales and other forms of conditional sale. Capital gains tax allocable to the unutilized portion 75000.

A 20 percent tax rate is charged when a person earns above that income. Final Capital Gains Tax for Onerous Transfer of Real Property Classified as Capital Assets Taxable and Exempted. Capital gains taxes.

According to Section 24D capital gains from the sale of real estate properties in the Philippines have a capital gains tax of 6 percent which is based on the gross selling price or current fair market valuewhichever one is higher of the two. Capital Gains Tax is charged at a flat tax rate of 6 of the gross selling price and must be paid within 30 days after each transaction. This includes capital gains from the sale of real estate property located in the Philippines classified as capital assets by individuals.

What is a Capital Asset. Lt is not the transfer of ownership or possession per se that subjects the saletransferexchange of the 6 capital gains tax but the profit or gain that was presumed to have been realized by the seller by means of said transfer. Capital gains tax CGT is imposed on both domestic and foreign sellers.

Capital gains tax otherwise due thereon 6 P 300000. When there is a sale of real estate automatically people think that they have to pay Capital Gains Tax CGT. The property was worth US250000 or 250000 at purchase.

If their income ranges from 40401 to 445850 they will pay 15 percent on capital gains. 1 In General. In computing the capital gains tax you simply determine the higher value of the character and simply multiply the same with.

D Capital Gains from Sale of Real Property. Notwithstanding the provisions of Article 14 relating to capital gains. Amount of exempt capital gains tax allocable to the utilized portion of proceeds from sale P3000000P4000000 75 times P300000 P22500000.

Gains on the sale of shares listed and traded on the stock exchange are taxed at 06. Capital gains generally are taxed as income. The rate is 6 capital gains tax based on the higher amount between the gross selling price or fair market value.

Stamp duty of Php 15 for every Php 1000 will apply to the transfer of real property. Depends on Notary Public. In other cases the Philippine tax is limited to 25 percent or.

050 Province 075 NCR. Capital Gains Tax is imposed on gain that the seller gets from a sale exchange or other transfer of capital assets that are located in the Philippines. Sale of real property is subject to capital gains tax at the rate of 6 on the higher of the gross selling price or fair market value.

Capital gains tax on sale of real property located in the Philippines and held as capital asses is based on the presumed gains. Capital gains tax on taxable income over 40400 dollars wont apply to individuals in 2021. CGT is a tax on the gain from the sale of capital assets.

What is Capital Gains Tax in the Philippines. The Philippine Tax Code grants the Commissioner of Internal Revenue the power to reallocate income and. The Withholding of Creditable Tax at Source or simply called Expanded Withholding Tax is a tax imposed and prescribed on the items of income payable to natural or juridical persons residing in the Philippines by a payor-corporationperson which shall be credited against the income tax liability of the taxpayer for the taxable year.

In computing the capital gains tax you simply determine the higher value of the property and simply multiply the same with 6. The Philippine tax at source is also limited to 15 percent provided that the paying corporation is registered with the Board of Investments and engages in preferred areas of activity. The rate is 6 capital gains tax based on the higher amount between the gross selling price or fair market value.

Pacto de retro sales and other forms of conditional sales are included in this. Capital Gains Tax vs. In arriving at effective capital gains tax rates the Global Property Guide makes the following assumptions.

Net capital gain is the difference between the selling price and the FMV of the shares whichever is higher less the shares cost basis plus any selling expenses. This is not necessarily the case. Paid Updated by Seller.

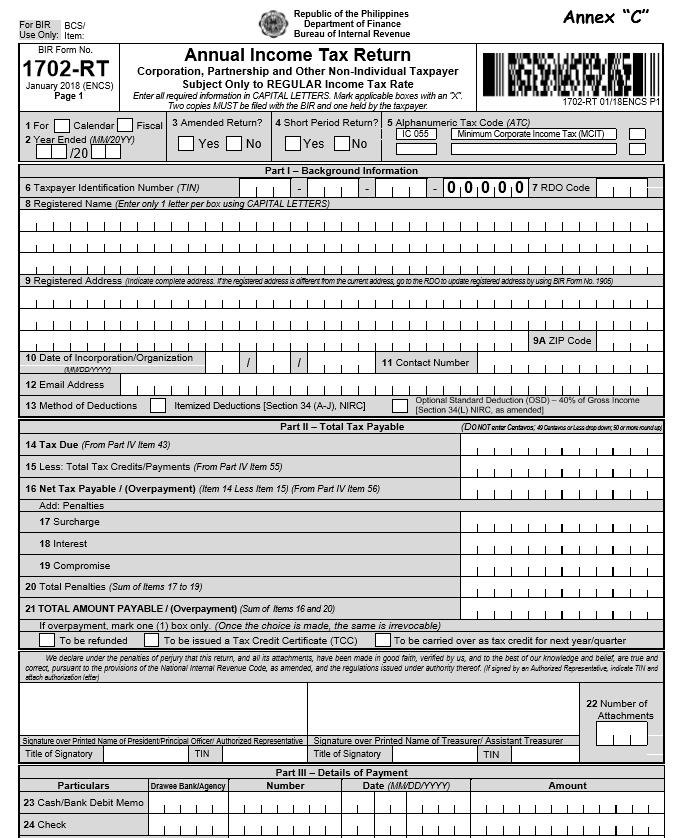

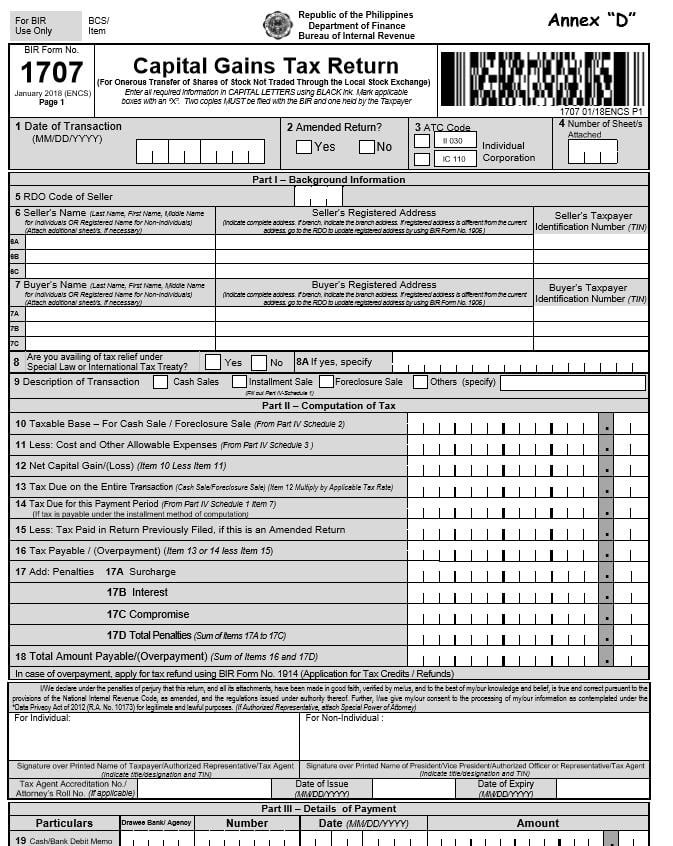

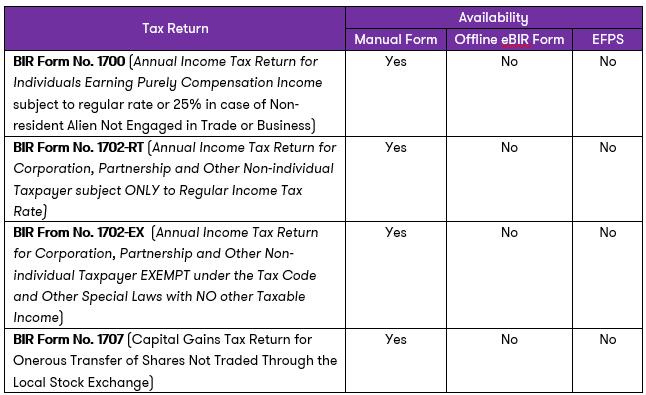

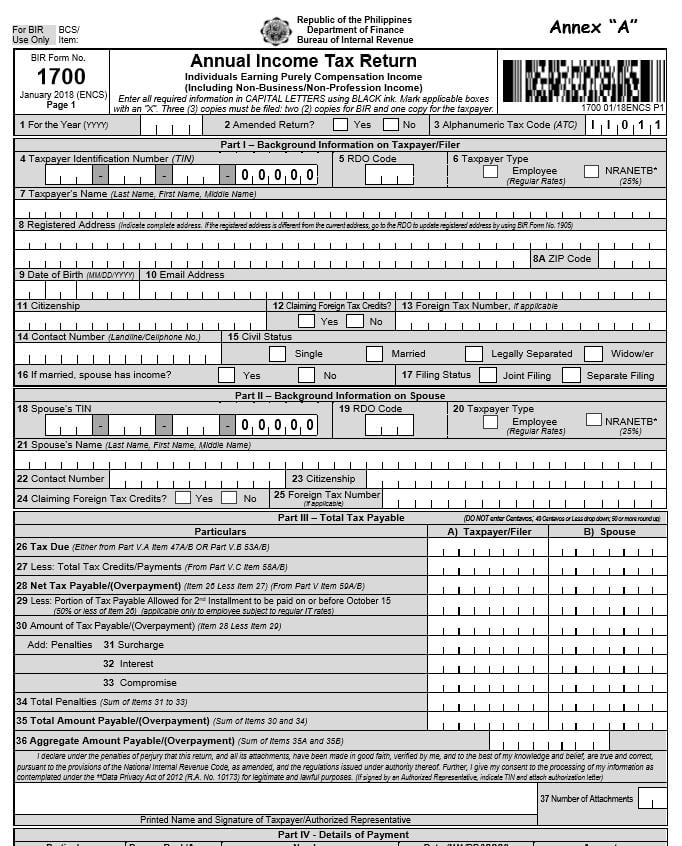

New Annual Income Tax And Capital Gains Tax Returns Grant Thornton

New Annual Income Tax And Capital Gains Tax Returns Grant Thornton

Capital Gains On Selling Property In Orlando Fl

Income And Withholding Taxes Ppt Download

Train Package One A Need To Know Guide To Republic Act 10963 Philippine Primer

How To Compute Capital Gains Tax On Sale Of Real Property Business Tips Philippines

New Annual Income Tax And Capital Gains Tax Returns Grant Thornton

Capital Gains Yield Cgy Formula Calculation Example And Guide

Q A What Is Capital Gains Tax And Who Pays For It Lamudi

12 Ways To Beat Capital Gains Tax In The Age Of Trump

How To Compute File And Pay Capital Gains Tax In The Philippines An Ultimate Guide Filipiknow

New Annual Income Tax And Capital Gains Tax Returns Grant Thornton

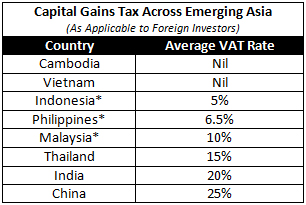

Capital Gains Tax China Briefing News

Train Series Part 4 Amendments To Withholding Tax Regulations Zico

Cgt Return Bir Form 1706 The Real Estate Group Philippines

Buying Property In The Philippines Youtube

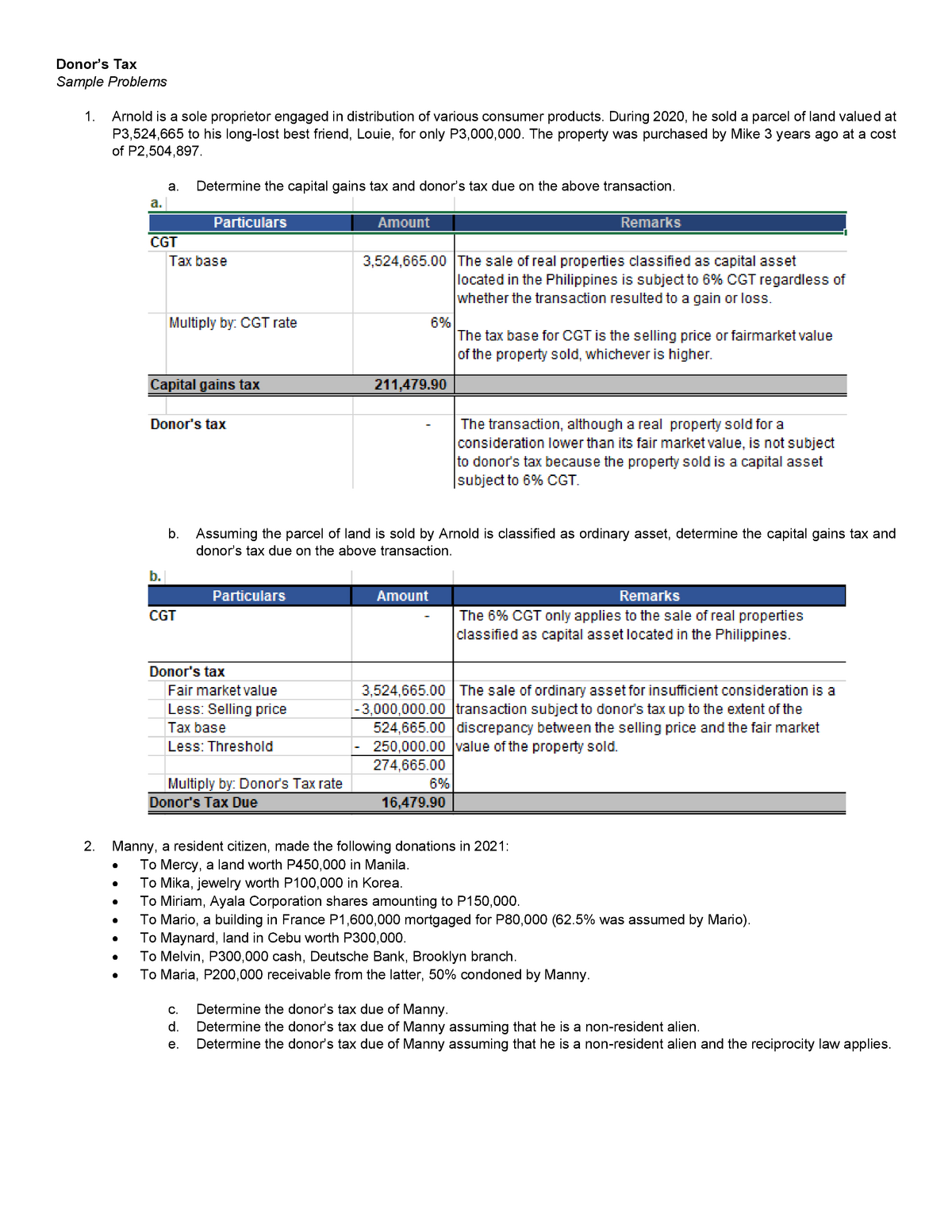

Donors Tax Sample Problems Donor S Tax Sample Problems Arnold Is A Sole Proprietor Engaged In Studocu

How To Compute Capital Gains Tax Train Law Youtube

Taxation Of Capital Gains In Developing Countries In Imf Staff Papers Volume 1968 Issue 002 1968